OneID® & SurePay's alliance aims to fortify businesses with an enhanced layer of protection, bolstering their ability to combat the increasing threat of online fraud.

UK Finance reported over 116k incidents of Authorised Push Payment Fraud in the first half of 2023. This is a 22% increase compared to a similar period in 2022. The amount lost was £239.3 million. The need to protect businesses and individuals from malicious actors has never been felt more.

It is against this backdrop that OneID®, UK’s leading document-free digital identity verification service, today announced its partnership with SurePay, a leading provider of Confirmation of Payee services. This strategic alliance aims to fortify businesses with an enhanced layer of protection, bolstering their ability to combat the escalating threat of online fraud.

SurePay's comprehensive range of services, including Confirmation of Payee, Confirmation of Payer, EU Verification of Payee, IBAN-Name Check for Organisations, IBAN-Name Check for Banks, Switch Check, and SurePay PayID, introduces a heightened level of certainty for individuals and businesses in verifying payee details. By combining these offerings with OneID®'s digital identity services that enable Digital ID checks, fraud checks and confirmation of bank account ownership, provides the most comprehensive defence for any business against payment fraud.

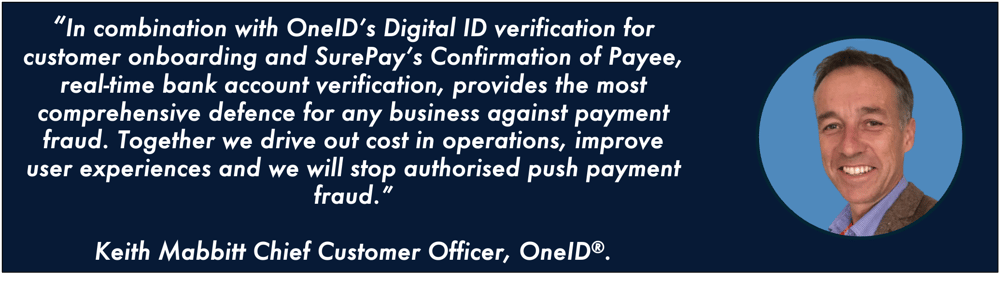

Keith Mabbitt, Chief Customer Officer, OneID®, said, “SurePay has an impressive clientele of over 100 banks and 300 corporates spanning diverse sectors such as automotive, technology, and food and beverage. The combination of OneID's bank-verified digital ID – accessible to ~50 million UK adults – will deliver added protection when onboarding their customers. In effect, this partnership will enable enterprises using payment services to quickly and easily verify the identity and bank account details of virtually every UK adult.”

Speaking about the announcement, David-Jan Janse, Chief Executive Officer, SurePay said, "In our experience, Digital Identity and Confirmation of Payee are a valuable combination. For both efficient onboarding, as well as preventing fraud and money laundering. We are therefore very much looking forward to working with OneID, the leading innovator in digital ID."

As the landscape of online threats continues to evolve, the combination of OneID® and SurePay's services enables businesses to meet regulatory requirements and restores the trustworthiness of digital infrastructure. This is one more step towards simplifying and securing the digital journeys of businesses and individuals.

OneID® is the only document-free, digital identity service provider that creates absolute certainty between a business and an individual in real-time. By leveraging bank-verified data, OneID® brings speed, simplicity and compliance to the digital identification process.

Our digital ID services use the most advanced counter-fraud measures to help protect banks, businesses and individuals from online identity fraud. By streamlining existing ID processes, including payments, direct debits, onboarding and more, we help businesses reduce operational costs, increase sales and improve customer engagement.

As the UK’s only identity service with access to bank-verified information, ~50 million individuals in the UK can use OneID® to prove their credentials online – instantly, without any app download or account creation. OneID® is government-certified, regulated by the FCA and is a B Corp business.

Headquartered in the UK, we have brought together the best people in Digital Identity, Payments, Banking, Technology and Government to ensure we make the world a safer place.

SurePay, the pioneer behind Confirmation of Payee (CoP) was founded in the Netherlands in 2016. As

the primary CoP scheme, our innovative and real-time solution gives payees

greater assurance that their payments are going to the intended beneficiary by checking the Account

Number & Sort Code in combination with the name given at the Bank. Preventing fraud and

misdirected payments & protecting payments in and out of Payment Service Providers (PSPs).

Presently, SurePay is connected to over 100+ Banks in the UK and Europe and serves hundreds of

Organisations. This translates into 7 Billion checks performed and 175,000+ no-match warnings

issued daily, both domestically and across borders.

Industry Accreditation:

When developing products and services in financial services, switching an identity partner is sometimes ...

-2.png)

In financial services, online identity verification is only “good” if it does two jobs at once: it reduc...

If you are a Customer Experience Product Manager or Risk and Compliance Officer still relying on Documen...

When you are responsible for delivery, automated KYC checks are rarely “just a compliance requirement”. ...