Protect your customers and your business from data errors and fraud. OneID® lets you capture the data needed to set up Direct Debits in a fully secure and compliant way – at the tap of a button.

Well-connected with banks

Evidence to defend indemnity claims

Identity confirmed by the payer’s bank

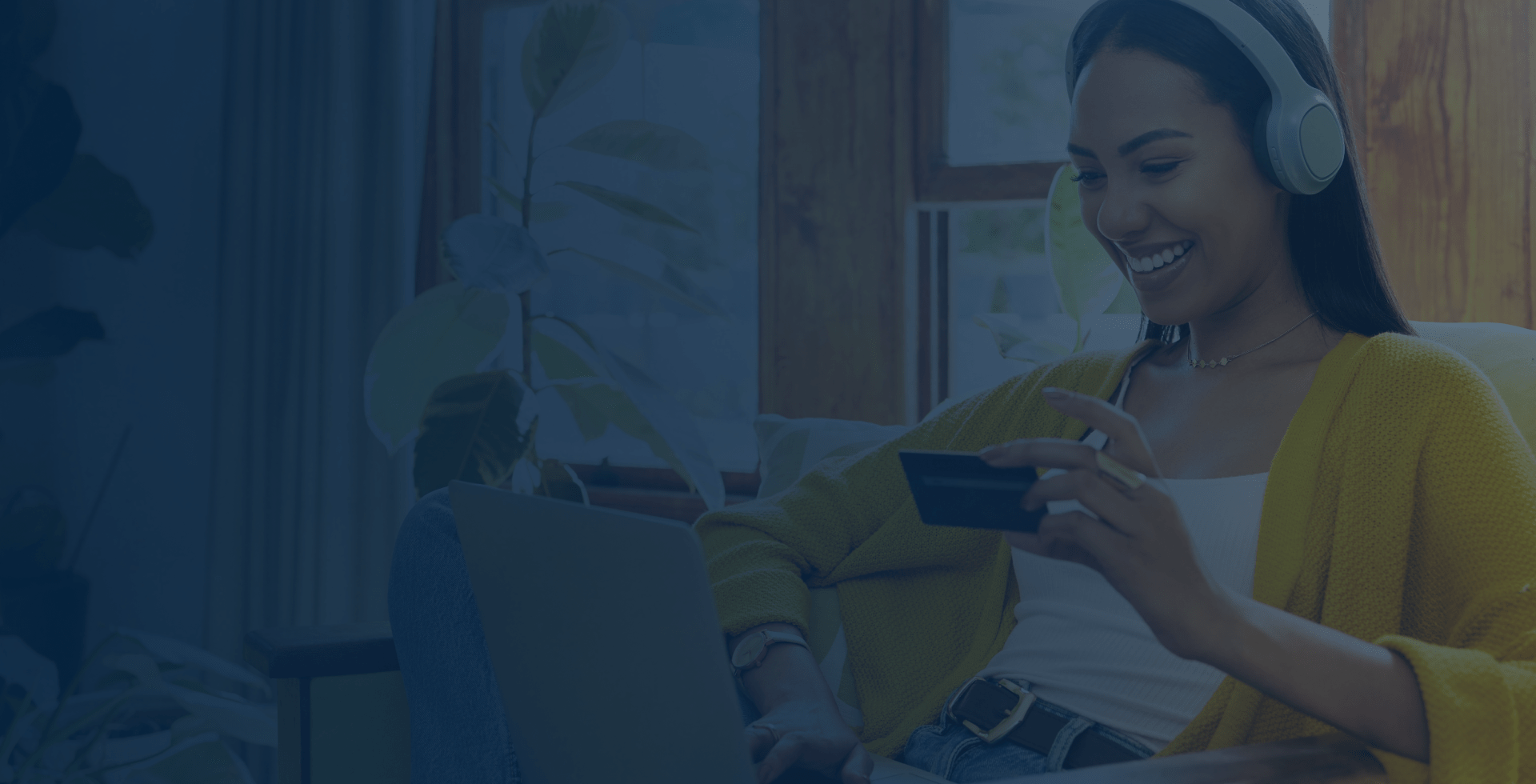

Take out your customer’s scamper for account details and fumble over keypads when setting up Direct Debits. Point them to the OneID® button on your website. Using the OneID® Wallet, repeat users can share their bank-verified account details to setup Direct Debits at the tap of a button, in an instant – no typing needed. Enjoy the rewards of an enhanced user experience that reduces abandonments.

Ensure the individual pressing the ‘Pay by Direct Debit’ button is the one who is authorised to do so. OneID® leverages multi-factor authentication, needing the customer to use their banking app and biometrics or their online banking and PIN to set up Direct Debits.

With a 100% digital identity solution linked to the user’s bank account and retrieves payment details, there is zero chance of an individual entering incorrect Direct Debit details – intentionally or innocently. That’s OneID® protecting your business from payment fraud and indemnity claims.

Each Direct Debit correction costs £50. Free up your human and financial resources from entering, checking and correcting Direct Debit manually. Reduce your operational costs and drive up productivity.

Utilities

Telecommunications

Financial Services

Payment Platforms

Local Government

Fill in the form to book a no-strings-attached demo and see how OneID® can help your business.