Combatting fraud, meeting compliance, and minimising player drop-offs—that’s a tough triple wager. But OneID® stacks the odds in your favour. With AML-certified identity checks and seamless onboarding completed in seconds, your players are ready to roll without the wait.

Zero-friction onboarding

Enhanced security

Prevent under-age gambling

Improved user experience

While traditional identity checks provide AML status at that point in time, they can expose you to future risks. OneID®’s digital identity checks are certified for AML use cases as per the Joint Money Laundering Steering Group’s (JMLSG) guidelines. By using the Open Banking rails to securely share identity data that are verified by the bank’s stringent KYC checks and is continuously monitored for AML activities – OneID® helps you meet Gambling Commission standards. Lower your risk of fines, licence loss, and non-compliance with OneID®.

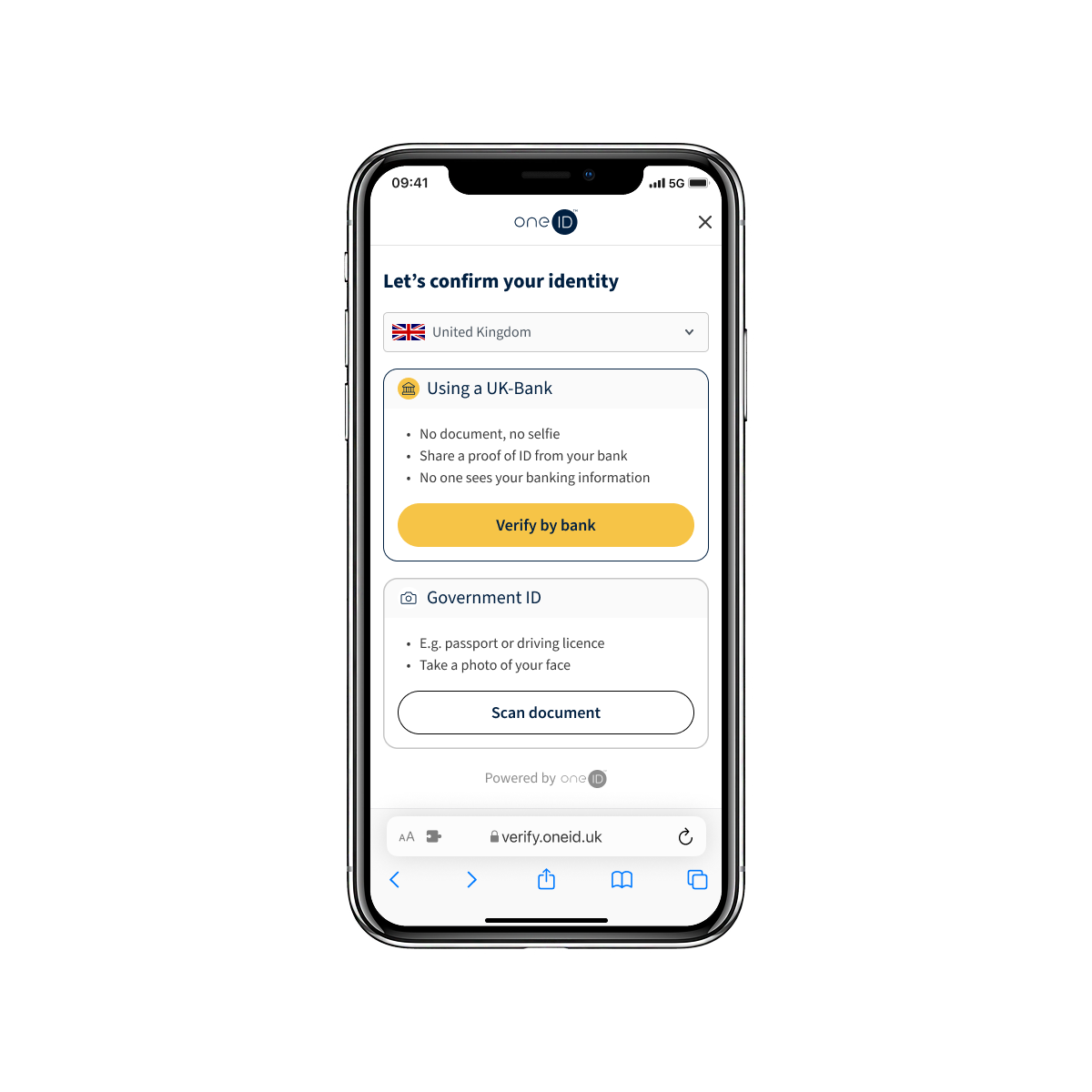

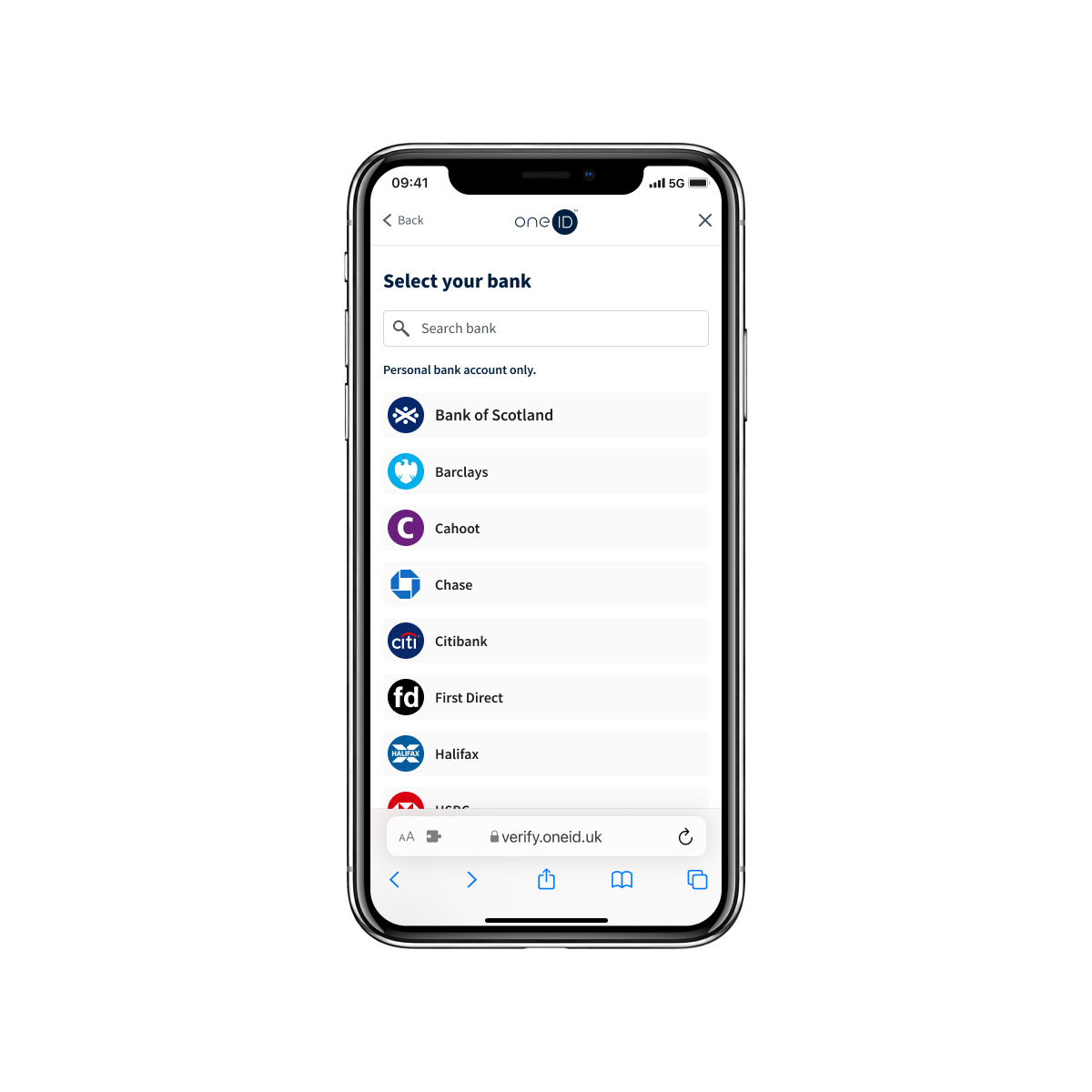

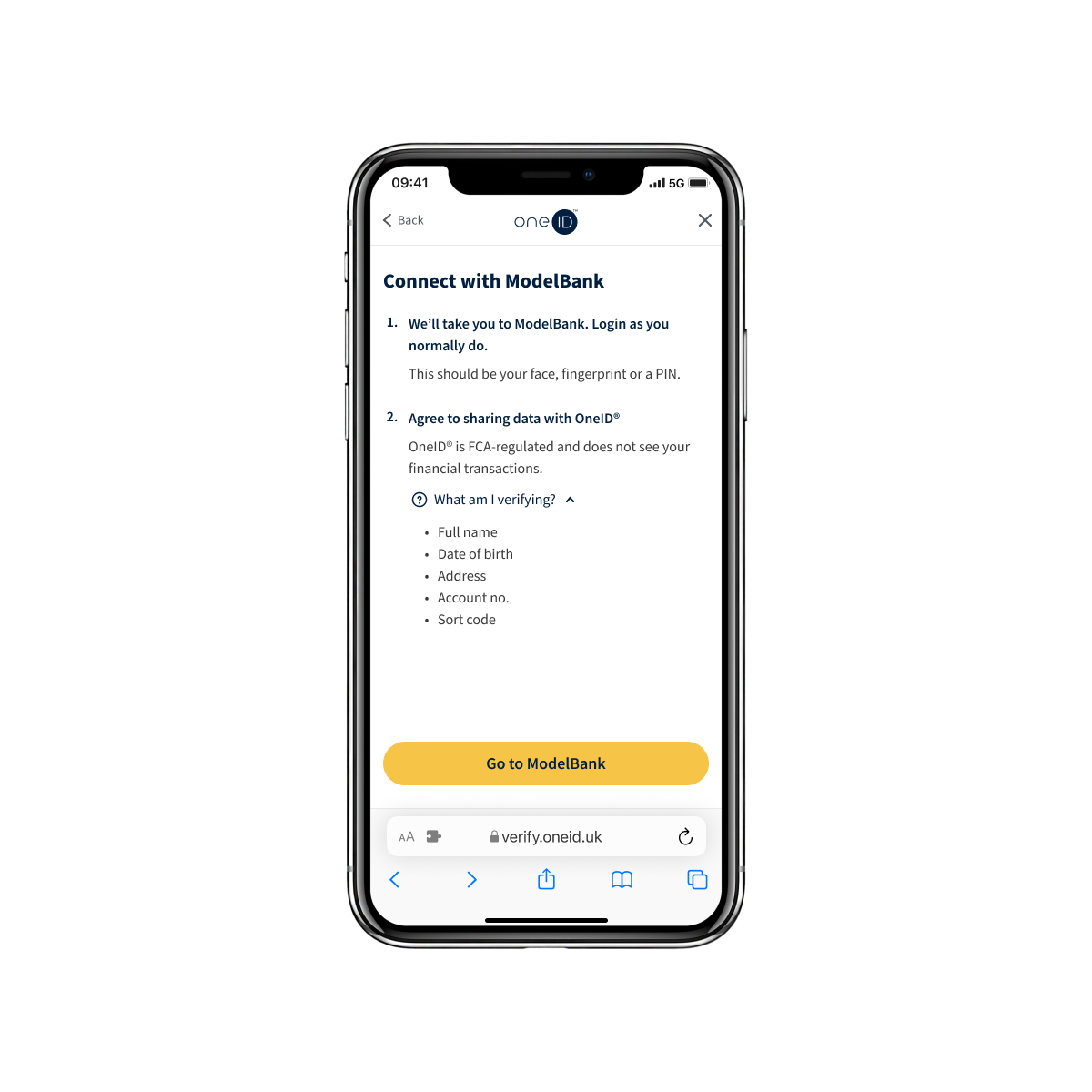

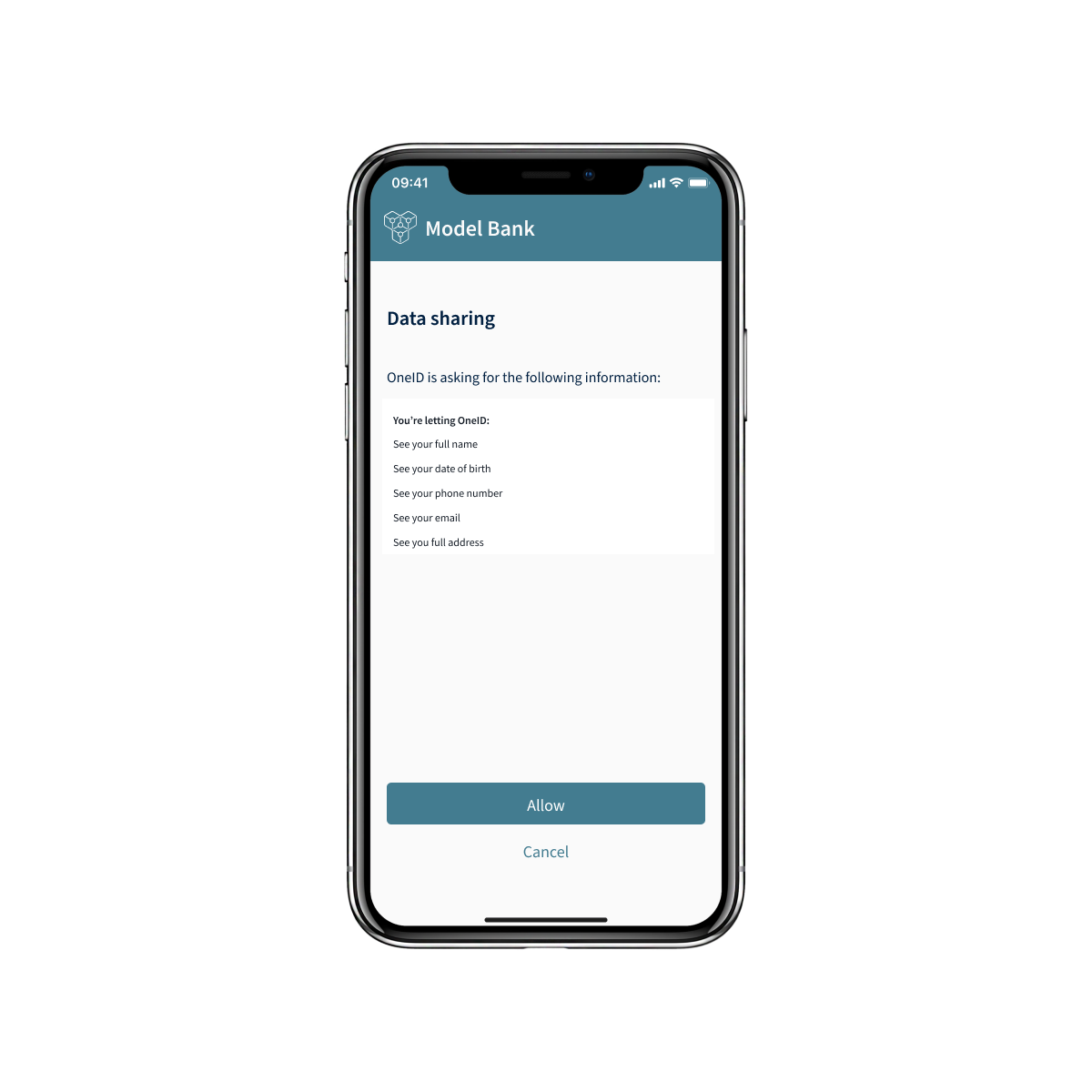

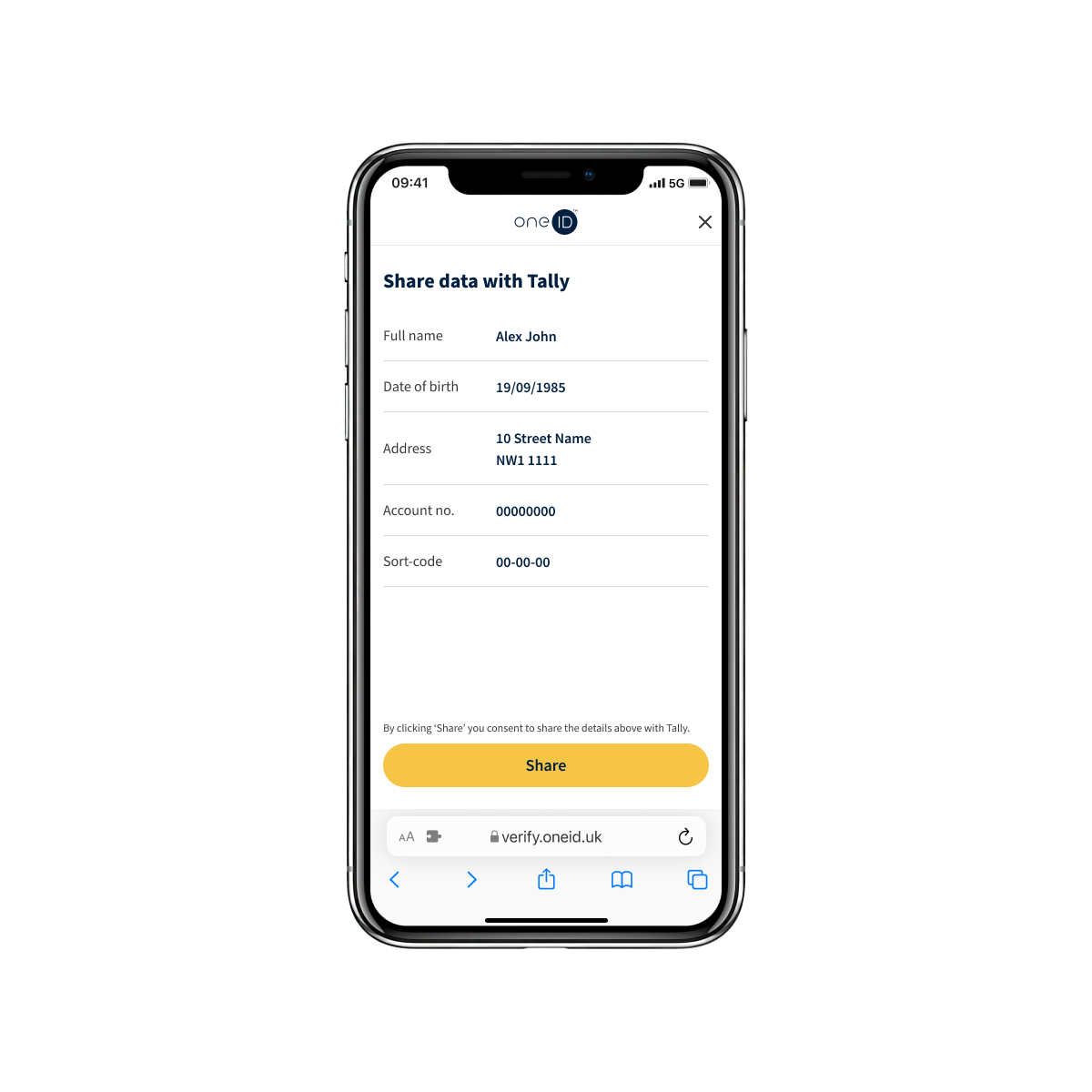

68% of onboarding processes are abandoned due to lengthy and complex processes, creating a poor customer experience, hampering the brand’s reputation and a loss in revenue. OneID® transforms onboarding with a frictionless, document-free identity process. In just three quick clicks – choosing OneID®, opening their banking app, and consenting to share data – a player can complete their onboarding in seconds. This fastest, easiest and safest way to onboard from OneID® elevates the user experience, gets players started right away and keeps them on your platform.

44% of identity fraud cases in gambling involved deepfakes or impersonation, and 49% of account takeover cases were related to unauthorised security or personal detail changes. OneID®’s document-free approach minimises the risk of deepfakes. By verifying an individual using the bank’s strong customer authentication measures, it considerably reduces the possibility of social engineering tactics to commit account takeovers.

Manual checks, typing in data, and making your players enter their details – they all lead to errors, delays, and duplication of efforts – the ingredients for inefficiency. OneID® delivers an end-to-end digital and automated process – eliminating the need for manual checks or typing in name, address or account details. The OneID® API securely and instantly auto-populates bank-verified information about the player on your platform – speeding up processes and taking out the cost of correcting errors.

Fill in the form to book a no-strings-attached demo and see how OneID® can help your business.