Absolute certainty of your customer's identity - in seconds.

Certainty for your business

Unrivalled UK coverage & 100% digital

Advanced counter-fraud measures

Rely on bank-grade security to protect your business from the increasing threat of online identity fraud. Have absolute certainty in your customer's identity - through bank confirmation - that they are who they say they are.

Best in class, bank grade security to protect your business from the many threats on the internet. Certainty on who you are dealing with via industry leading secure customer authentication.

All the information you need to safely onboard a customer in seconds. Counter-fraud, affordability, regulatory checks and credit scores all - from trusted, verified sources. And just seconds for your customer.

Compliance – we’ve got it covered. OneID® is FCA-regulated and certified under the UK Government’s Digital Identity & Attributes Trust Framework (DIATF) as a reusable identity provider. Get identity assurance up to very high confidence levels.

The OneID® Wallet further elevates and streamlines what is already the easiest way to prove who you are online. Repeat users of OneID® can complete the verification and onboarding process at the tap of button – reducing friction and increasing conversion.

Get going in a few hours with direct integration into your website, application or service. Industry standard, Open Identity connect interface makes it easy to connect to our APIs into your system.

Protect your customers privacy with no oversharing, consent driven sharing of personal information, no document uploads, no live selfies and most importantly, no hassle.

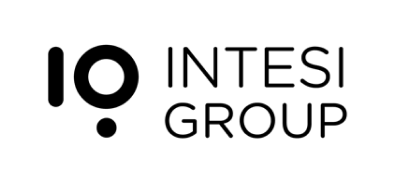

In the first step we ask the customer to consent to share their personal information and then direct them to their bank.

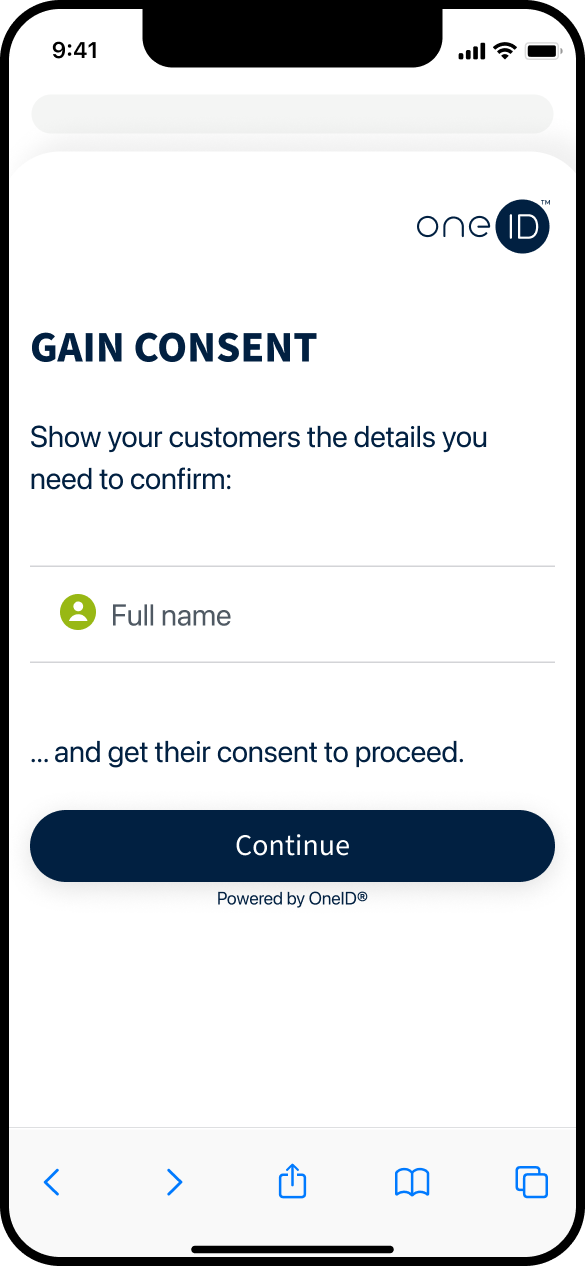

The customer authenticates with either their bank online service or mobile banking app and then the bank confirms their identity.

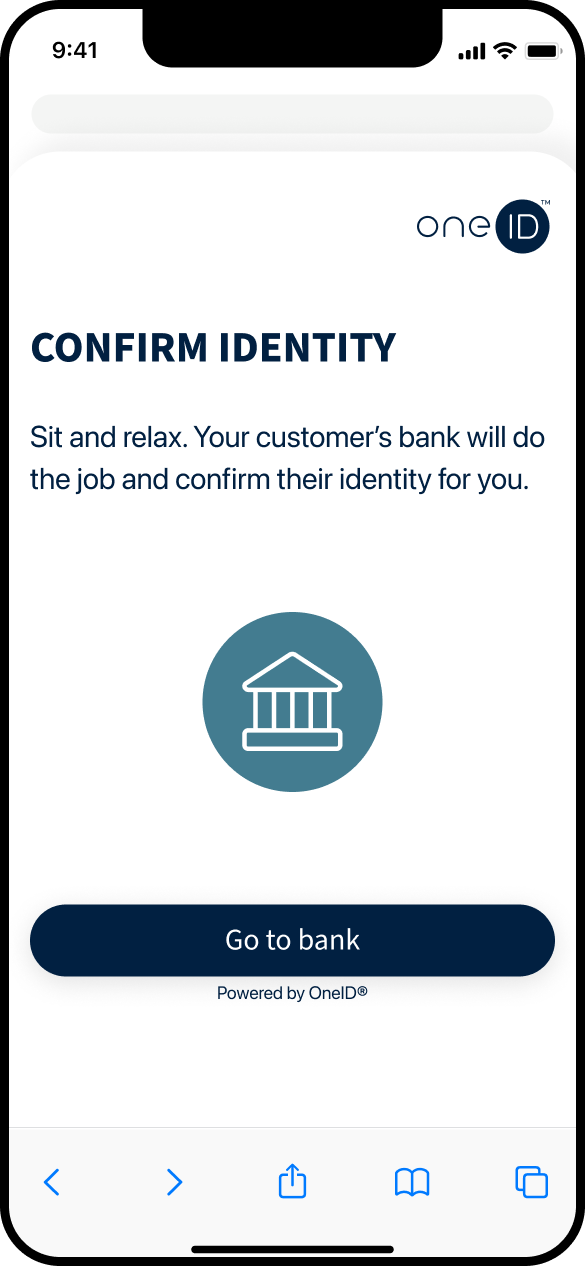

Depending on the information requirements of your business, OneID® will then enrich the customer's personal information with indicators relating to identity fraud, affordability, regulatory checks (sanctions list / financial crime) or account history.

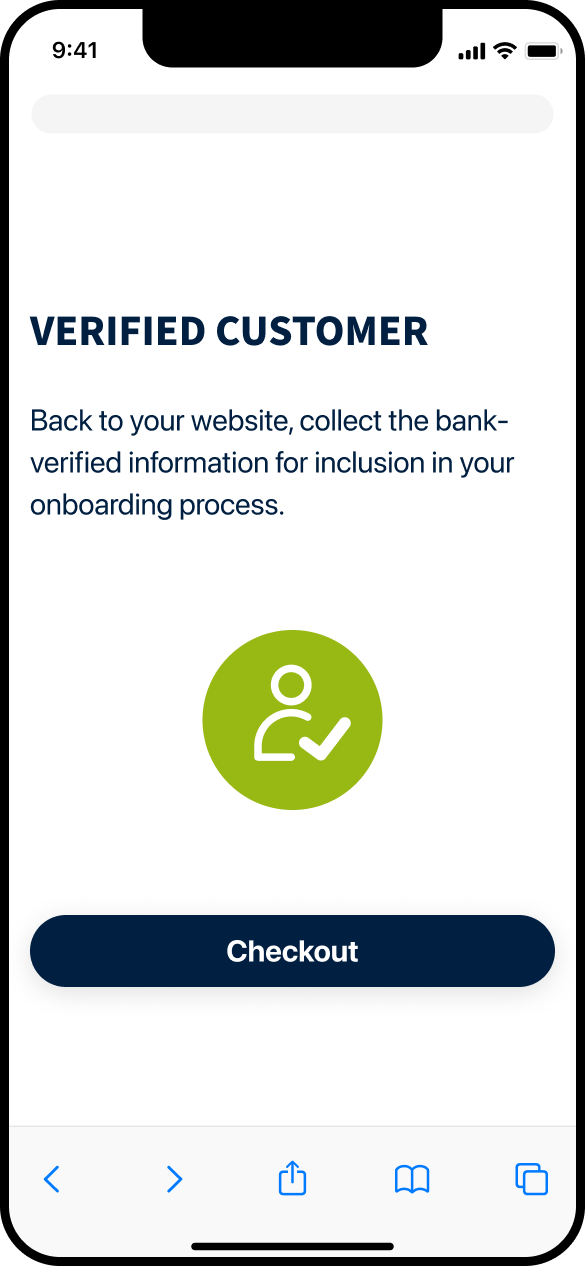

In the final step we enable your system to collect the information for inclusion into your customer onboarding process.

Financial Services

Insurance

Payments

Professional Services - Legal & Accounting

Recruitment

eSigning

Home Letting

See it for yourself.

OneID® verifies the identity of your customer in seconds, using the information that already exists at their bank. No more long, fiddly forms, no more passport uploads, no more hassle.

For businesses who really need to know their customers.

Verifying yourself using OneID® is completely voluntary – your online space is yours to control. However, other people can choose to turn off comments from accounts that haven’t verified themselves. Accounts who haven’t verified themselves can still use social media; they just can’t leave comments on someone’s profile who’s decided they only want to see content from verified users.

Unlike verification methods that require government-issued documents such as passports and driver’s licences which are often costly and exclusive, OneID® is incredibly accessible - all you need is a bank account.

No - we only share a unique code that is paired with your bank account to verify you are who you say you are.

When developing products and services in financial services, switching an identity partner is sometimes ...

-2.png)

In financial services, online identity verification is only “good” if it does two jobs at once: it reduc...

If you are a Customer Experience Product Manager or Risk and Compliance Officer still relying on Documen...

Get in touch with our team, we're always happy to chat, alternatively, visit our Developer Documentation.

To find out how our identity verification solutions can work for you, please fill in the form, and one of our digital identity experts will get in touch within 1 business day.