Introduce the speed and simplicity of document-free ID checks to your KYC process. OneID® checks multiple data sources within 12 seconds in a secure and compliant way that elevates the user experience.

Document-free ID checks

Most stringent fraud checks

Utilises bank secure authentication and verification

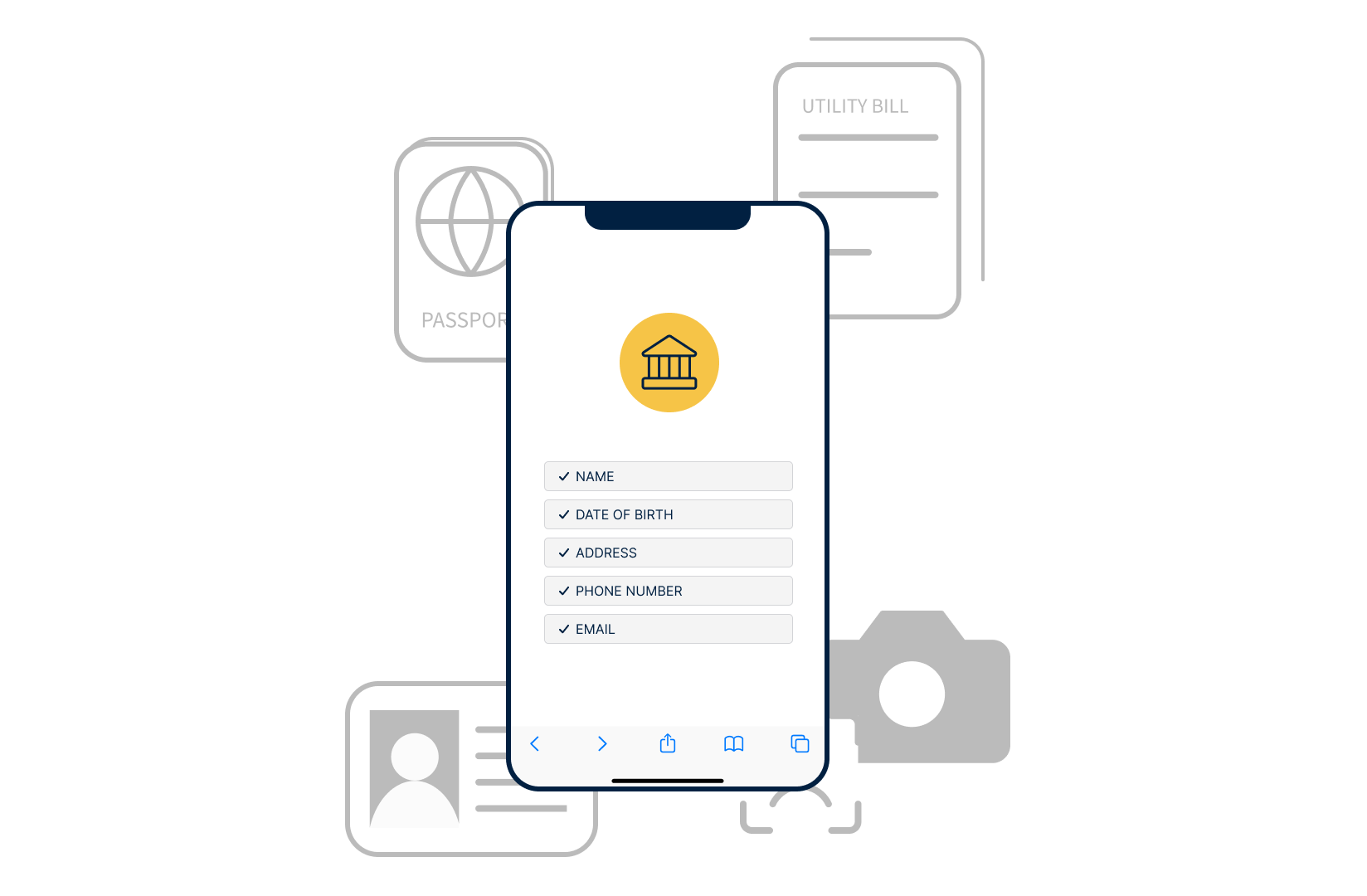

Unlike the laborious, traditional document-based methods, ID checks with OneID® are 100% digital and document-free. The result — identity verification that can be completed seamlessly, on mobile, instantly and from anywhere at the point of need.

The OneID® Wallet helps you take out the time and effort from identity verification in a KYC process. Repeat users of OneID® can verify their identity or auto-fill forms just by clicking a button to share their bank-verified identity details, without having to drop whatever they are doing. That’s two thumbs up for user experience.

Get the information you need to complete your Customer Due Diligence checks in seconds. The OneID® API returns identity data that has been verified by banks, and can also include PEPs and Sanctions checks.

Get absolute certainty about an individual’s identity. OneID® provides 2+2 evidence points in real time about a user from their bank (with consent), and other data sources such as credit reference agencies and industry fraud databases, and shares it via a single API.

OneID® is independently certified against all of the JMLSG requirements

.

Take a look at how OneID® can transform the KYC process within financial services, banking, insurance and other industries for whom KYC and CDD are critical to survival.

Financial Services

Banking

Insurance

Legal

"Since the inception of ANNA Money, we’ve aspired to transcend traditional, paper-based verification methods. The adoption of OneID’s digital ID solution has not only aligned with our vision but has tangibly enhanced our customer onboarding experience. We’ve observed a significant 50% reduction in verification drop-offs at points where additional information was typically required. This innovation doesn’t just represent a step forward; it’s a leap into a more efficient, secure future for our customers and our business alike."

Fill in the form, to book a no-strings-attached free demo and see how OneID® can help your business.