Digitalisation has brought us convenience that is hard to live without today. But it has also set the stage for identity theft, fraud and financial crime. According to McKinsey, the amount of money laundering that occurs every year is equivalent to 5% of the global GDP.

This heightened need for identity certainty has spurred the growth of the KYC industry. But amidst hard economic conditions and tough competition levels, this has become a landscape riddled with complexities and challenges.

Increasingly, KYC platform providers find themselves up against six major problems:

1. Rising operational costs and thinning margins

2. Undifferentiated services in a crowded market

3. Dull and frustrating customer experience

4. Time-consuming and error-prone manual KYC processes

5. Lack of easy-to-deploy value-add integrations

6. Cost-effective ways to expand and retain the customer base

In this blog, we’ll look at the pain points KYC platform providers are grappling with and explore solutions they can integrate as part of their future-proofing strategy.

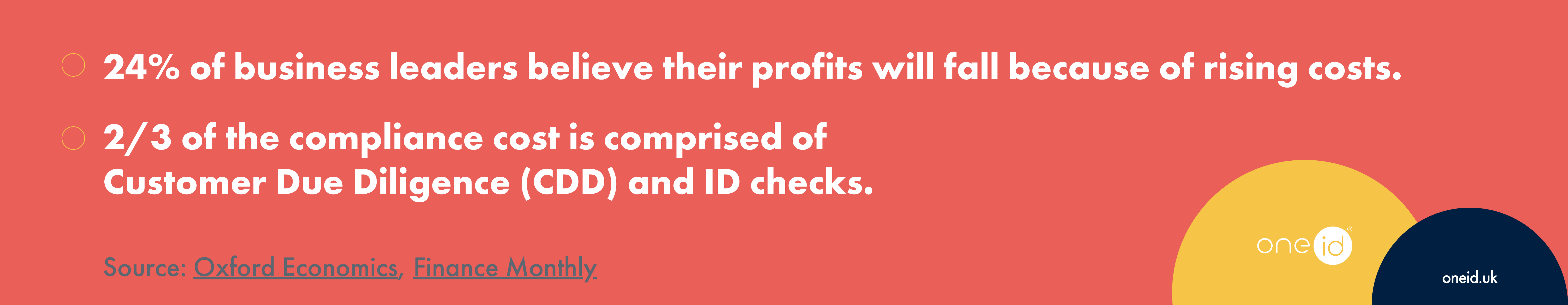

The cost for UK businesses has increased by 7.25% in the past year. In the 12 months leading up to August 2023, labour cost has gone up by 23%, according to the Office of the National Statistics (ONS).

For KYC providers, the operational cost also includes the rising cost of identity checks. Compliance costs rose by 19% in the last two years. With the increasing volume of ID checks, the costly traditional methods of identity verification continue to eat into the already thin margins of KYC providers – especially the small and medium-sized ones.

Digital identity verification solutions present KYC providers with a swift, non-disruptive way to reduce operational and identity verification costs and increase margins. Adding a solution like OneID® - 100% digital and a fraction of the cost of traditional ID checks – can both minimise operating costs on ID checks and open up higher profit margins when sold forward.

KYC as a category has been commoditised, with many KYC providers offering a similar suite of services that relies on cumbersome document-based identification methods.

In a market with little differentiation between providers, and where KYC and CDD checks are performed primarily to avoid hefty fines, price will become the deciding factor for businesses. It could force KYC providers to cut prices, threatening business continuity considering the cost and margin pressures they are already under.

By adding a zero-document identity verification solution to your KYC offering, you can stand out from the rest and offer a genuinely different, truly digital option to customers. Integrating such innovations, like OneID®, could make speed, ease and document-free a key part of your value proposition. An easy way to strengthen your ID-check workflow.

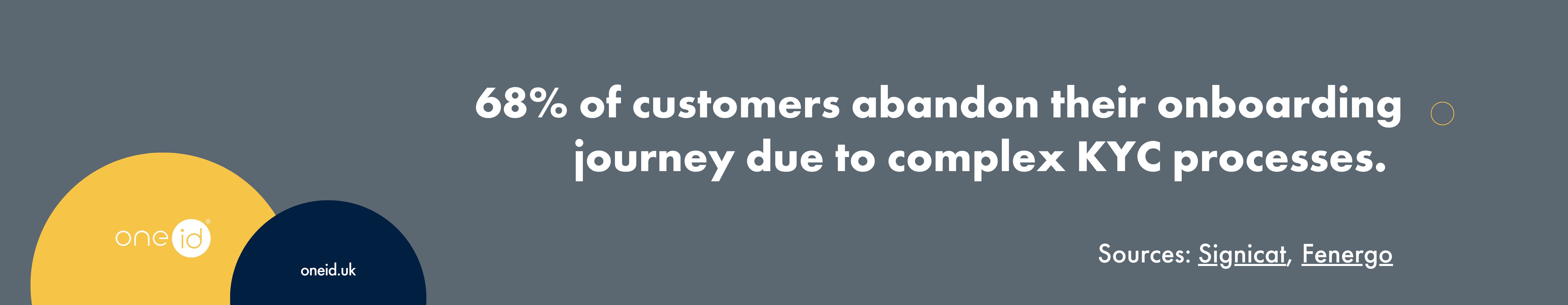

For customers who have experienced the ease of digital native brands, additional steps like document scans or app download and registration are unnecessary friction points. The use of physical documents for identity verification anchors the KYC journey in the 20th century – often needing multiple contacts for additional documents. KYC platforms have had to contact end-users as much as eight times – causing increased abandonments. The knock-on effect of subsequent negative perception can be equally as damaging.

Platforms that offer a truly digital KYC journey, which could be completed on mobile seamlessly and swiftly, will benefit from more KYC completions and, therefore, higher revenue. Identity checks with OneID could be completed from anywhere in under 10 seconds, no document upload, no photos, no hassle.

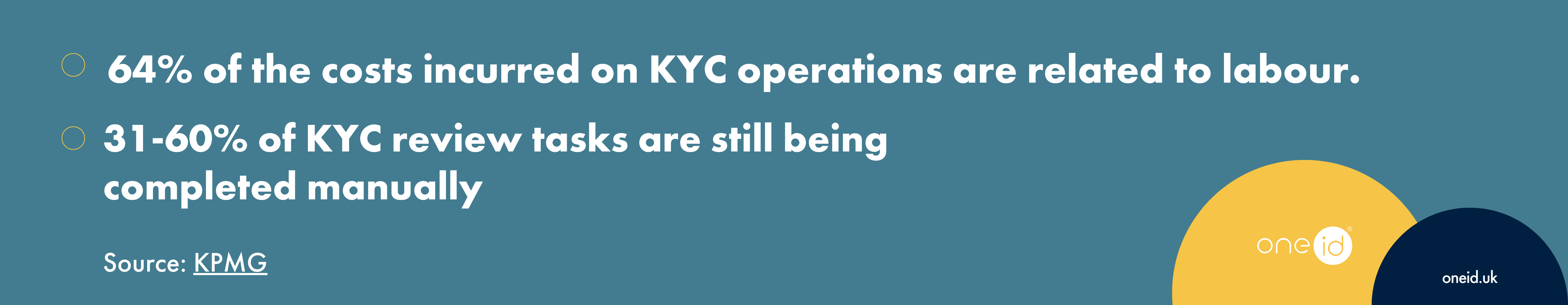

One of the biggest factors slowing down KYC platform providers is their labour-intensive nature. 31-60% of KYC review tasks are still being completed manually. Little wonder that it takes between and 1- and 50 days to complete KYC reviews.

Manual document verification puts KYC clients in a state of indecisiveness – which could lead to loss of business and revenue for KYC platform providers. More importantly, manual processes divert valuable human resources from the more critical and strategic tasks.

Integrating a solution that eliminates manual hours will bring speed to the process and give KYC analysts a chance to upskill themselves and solve more complex problems. Bank-verified digital identity solutions, like OneID, use the open banking framework to complete an ID check in a few clicks without human intervention.

Even the slightest service outage could lead to severe consequences for KYC providers. When adopting new technology and transformative solutions, they must do it in the least disruptive way. Many new initiatives get postponed because of the cost, training, and time required to roll out a new solution.

Simplistic yet robust technology integrations, like OneID, which are essentially just a line of code, could save KYC platforms the days and weeks needed for deployment. By deploying these solutions in hours, they could be monetised right from day one.

11 million UK citizens do not have a document form of identity. KYC providers using conventional document-based identification will miss out on this sizeable chunk of their user base. In a market teeming with players, the unavailability of even the smallest customer base makes the situation much more challenging for KYC providers.

Identity verification solutions, like bank-verified digital identification, use the results from the KYC checks done by banks when opening an account. So, if a user has an online bank account, they can be ID-checked. This brings in 8% of the UK population who don’t have a passport or a driving license into the folds of KYC providers.

By adopting advanced identity verification methods like bank-verified digital identity, KYC businesses can completely digitalise and streamline the process. This would reduce costs and time taken to complete each case. Instead that time and investment can be focused on other business-critical priorities such as training their team on the complex KYC, AML and CDD compliance framework that needs human intervention.

Integrating a simple and easy identity-checking method into your KYC suite will deliver a better customer experience, differentiate your offerings in the market, and help them build capacity and introduce new value propositions.

Agentic commerce is already operating inside live retail, payments, and platform environments. For Partn...

Online identity verification entered a new phase in 2025. Across adult platforms, gambling, financial se...

Last month, we joined Turnkey for an industry event to talk about a challenge many regulated platforms a...

2025 has been a year of continued growth and real-world proof for OneID®. As expectations for identity a...