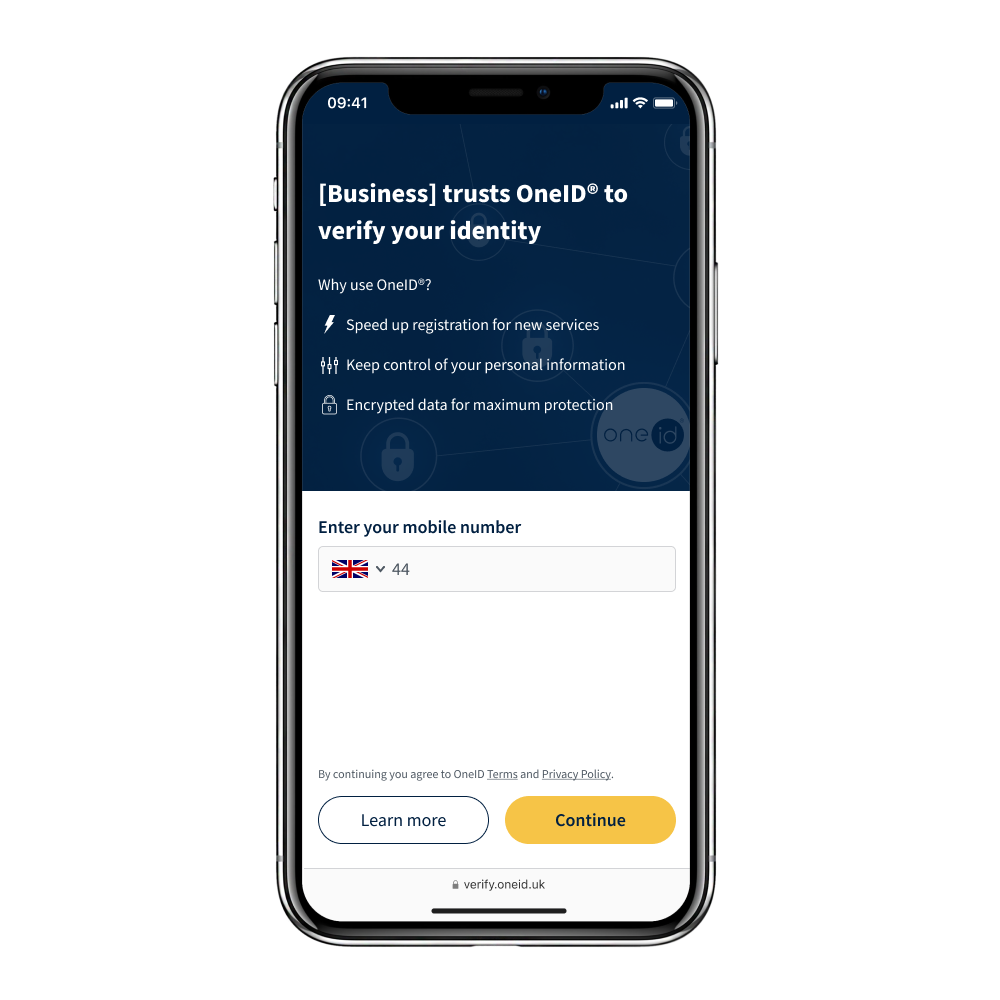

OneID® is the quickest and easiest way of verifying your identity, age or onboard to an online service. With this simple step by step guide you will learn what to expect and how to make the most of the only truly digital identity service in the UK.

You can use either a mobile phone or a desktop to complete your verification using OneID®.

If starting on a desktop, we recommend scanning the QR code when prompted so that you can access your bank via your banking app on your mobile phone. This is the quickest way of completing the process.

If don't have a banking app or your mobile phone with you, you can also login to your bank on your desktop.

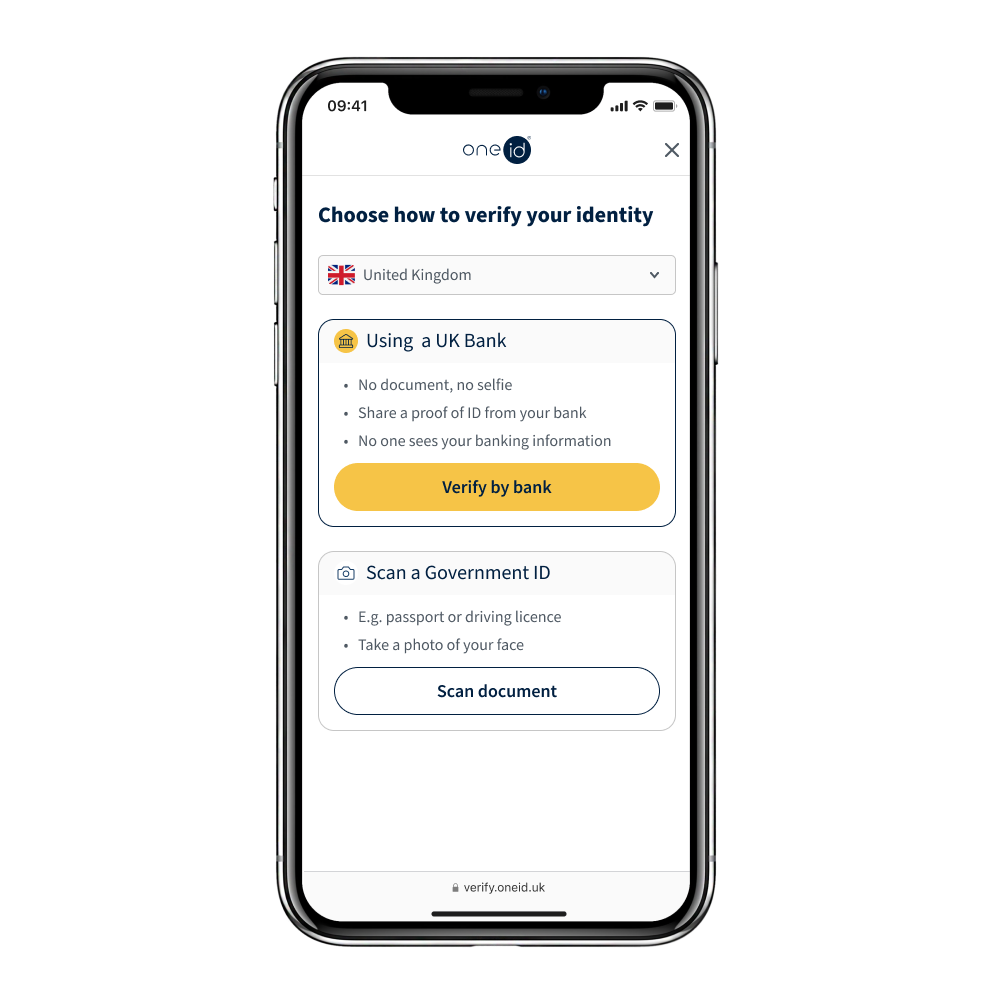

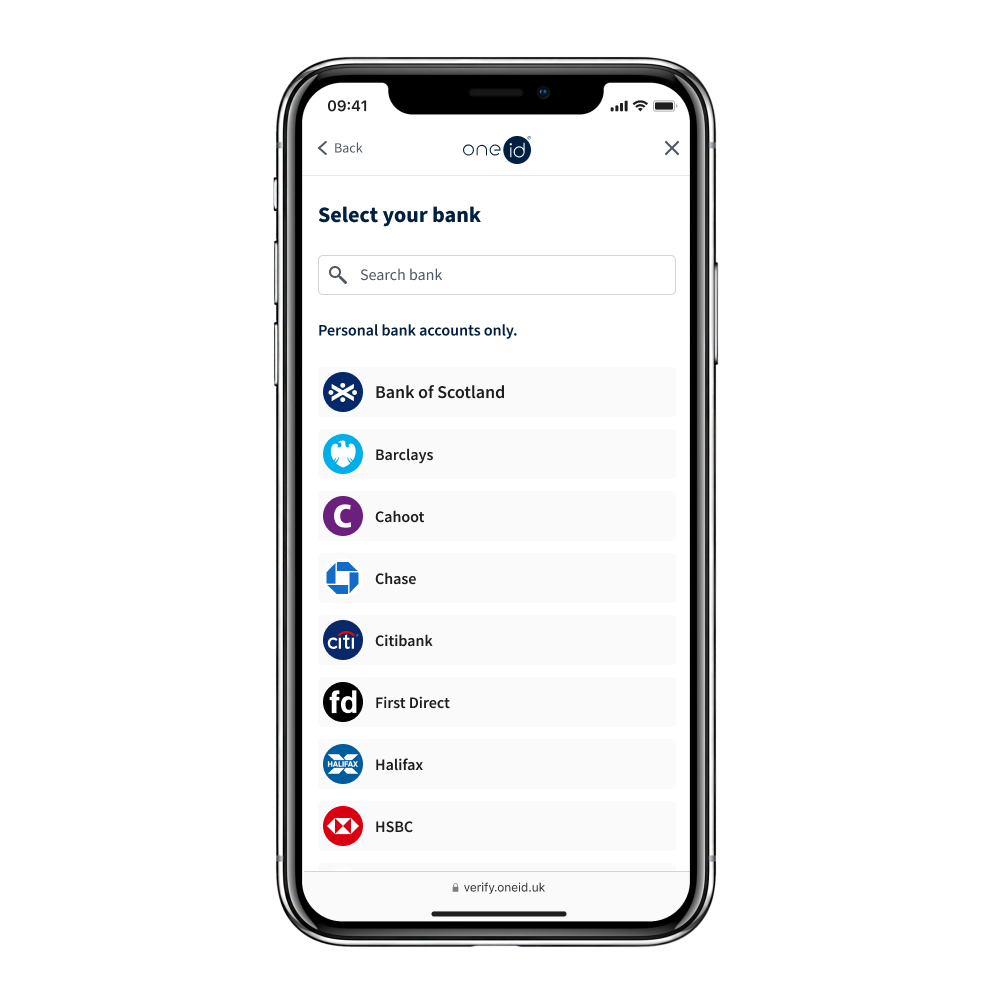

UK Bank: OneID® is proud to partner with most major UK banks to offer a quick and easy identity verification process without requiring physical documents. For an even faster experience, we recommend selecting a bank where you already have a mobile banking app.

International eID schemes: OneID® has partnered with eID schemes in over 15 European countries, including Itsme, BankID, and others.

Document scanning: In some cases, we may need to verify your identity using a document. Please have your passport or driving license ready,along with your camera for a live selfie.

With OneID®, your personal information remains secure behind layers of bank security, and only you consent to what is shared and with whom. It's your data and you're in control.

No payment will be taken from your account and no one will see your account balance or transactions - you're only sharing the information previously listed to you.

✓ Speed - Under 12-second identity or age verification.

✓ Fully digital - Document-free identity checks using a UK bank or OneID®'s international partner.

✓ Private - Only share the minimum data needed (e.g. full name for an identity check).

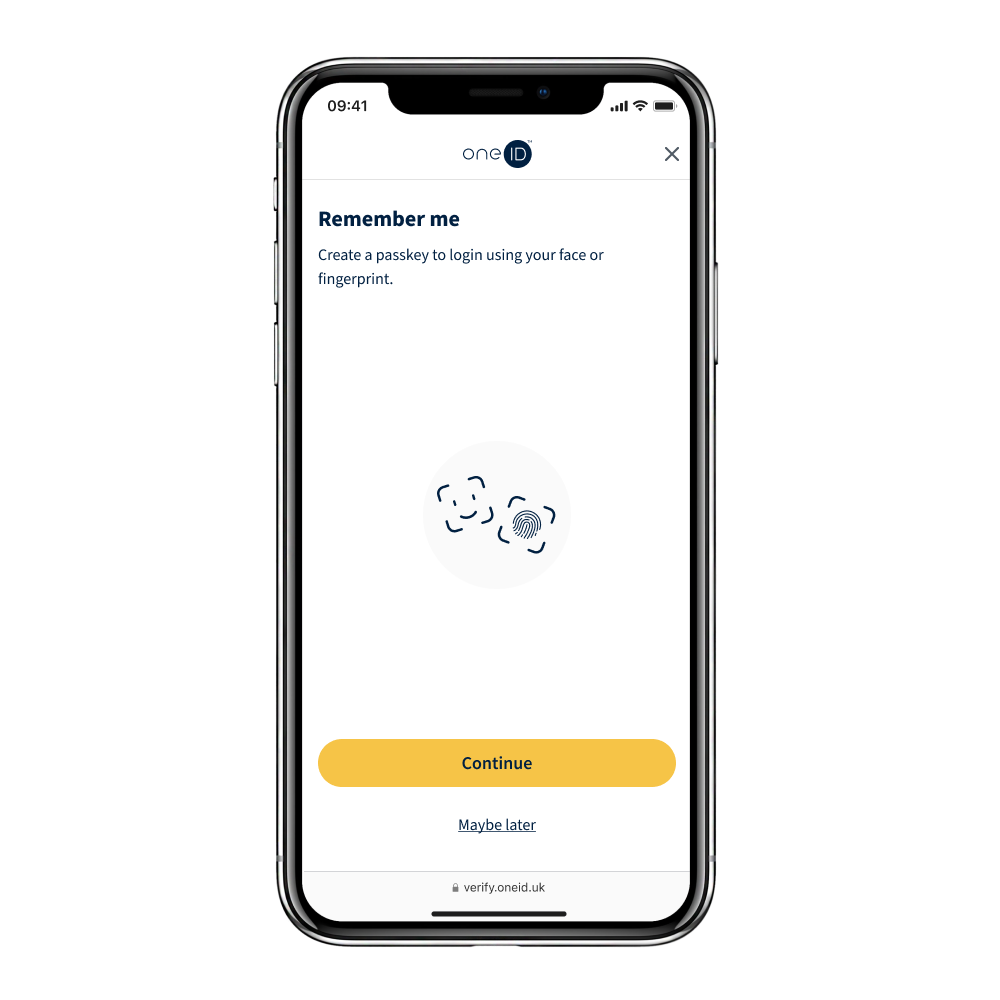

✓ Reusable - If available, create a passkey to reuse your verified information seamlessly next time.

✓ Secure - Advanced encryption for maximum protection. Only your face or fingerprint can decrypt and see your stored information.

Using OneID® will save you time and takes the hassle out of all the processes that require you to confirm your identity, age or onboard to a service online. Below you will find a step by step guide on the process:

If you're asked to enter your mobile number, you'll receive an SMS with a 6-digit code. Enter this code to continue. In the future, you can use this phone number to re-use your verified details and check all your data sharing transactions history in the OneID® Console.

If requested, create a passkey so you can access your OneID® account using your face or fingerprint in the future. This means that if you need to verify your identity or age again, you won’t have to go through the verification process once more.

OneID® works with major UK banks and several international partners to help you verify your details quickly and securely with just a few clicks. For a faster process, we recommend using a UK bank. Alternatively, OneID® also offers a document scanning option.

If this screen doesn’t appear during your OneID® journey: That's ok. It means the business requesting an identity or age check only accepts one verification method. If you're asked to select a bank, please jump to Step 4. If you're prompted to scan a document instead, please prepare your mobile camera.

For a quicker process, we recommend selecting a bank for which you have a banking app installed on your mobile phone.

Please note that our service is designed to verify your identity. Even for business purposes, we can only accept personal bank accounts unless explicitly stated otherwise. Joint accounts are not supported for the same reason.

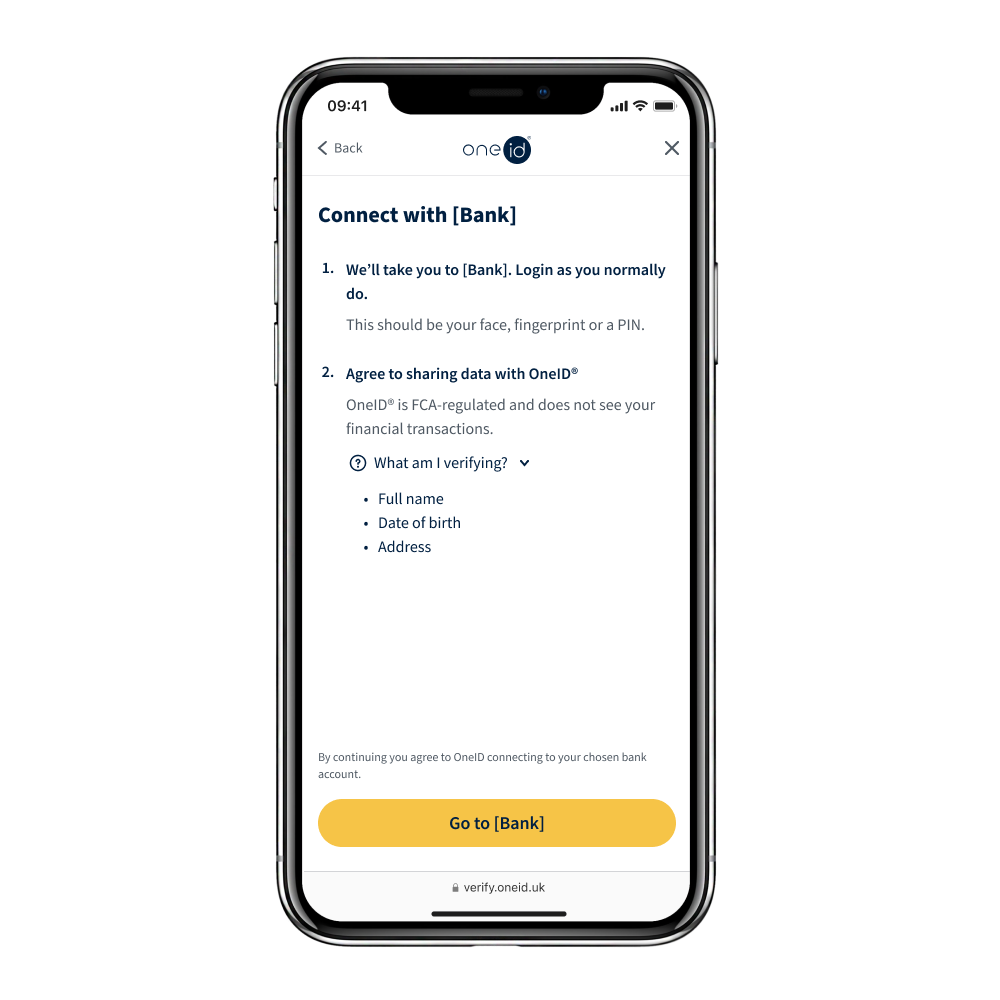

OneID® will ask to connect with your bank to get a confirmation of the information being verified, e.g. your name, address or date of birth. No one but you will have access to your bank account and no payment is taken. OneID®'s sole purpose is to verify identity information.

When your bank app or website opens, login as you normally do.

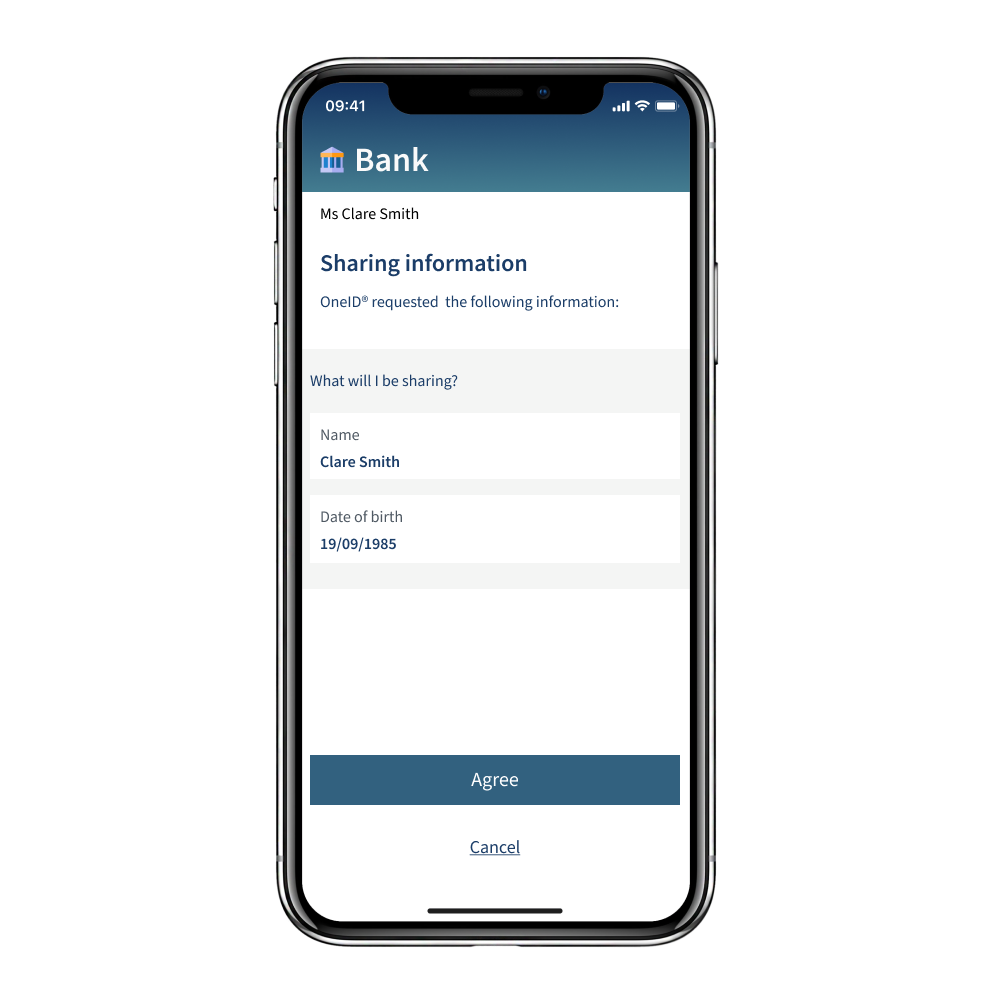

The experience may vary by bank, but typically your bank will ask you to agree to share data with OneID®.

Only the details specified in Step 5 will be shared, no payment will ever be taken and no one will have access to your bank account.

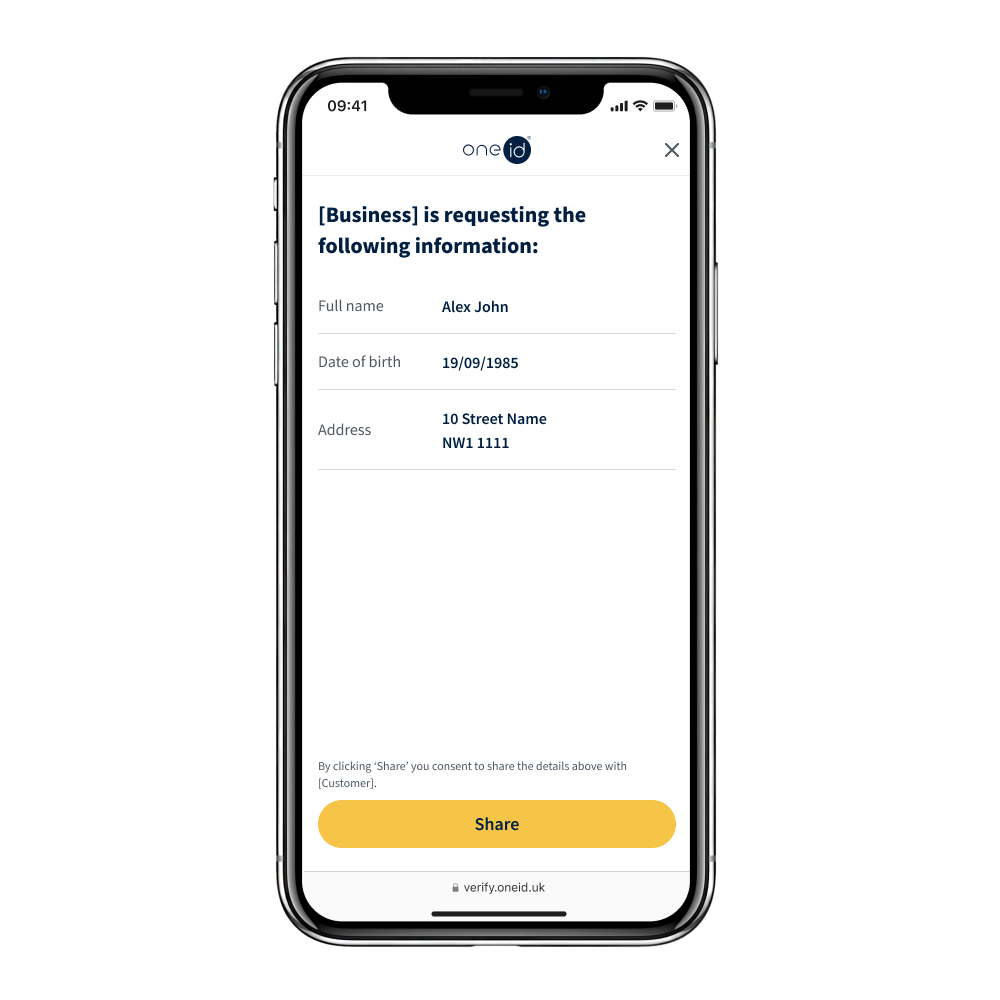

After your bank, international provider, or document scanning tool successfully verifies your details, OneID® will always show you exactly what information will be shared and to whom.