Creating a frictionless customer onboarding journey is not without its challenges. When you're responsible for growing the business while preventing scams, remaining compliant while keeping the cost-base minimised, eliminating friction in the sign-up process may feel like quite an ask.

Here our CEO, Paula Sussex, shares some of the most common questions she receives from FSI businesses around customer onboarding. In this blog she’ll cover:

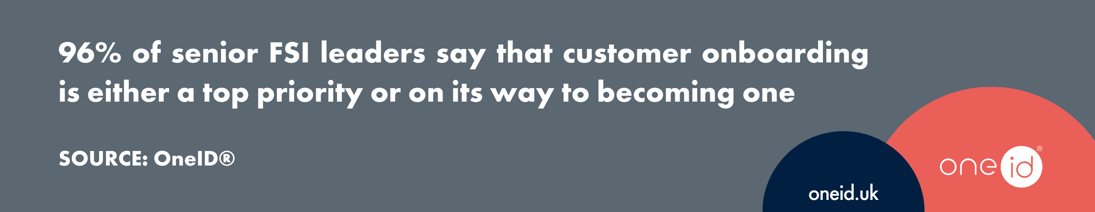

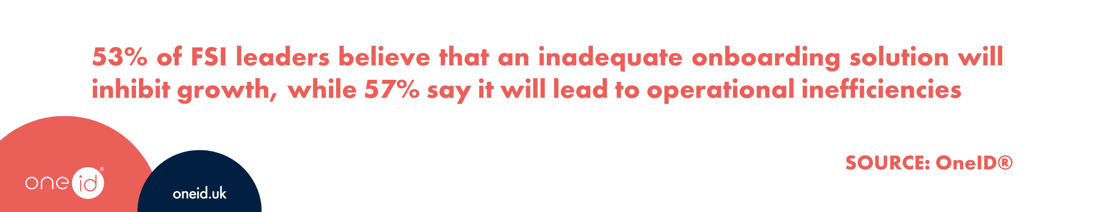

In our recent study, business leaders identified three primary sources of friction: due diligence (29%), customer data capture (24%) and account set-up (15%). So those are areas where FSI businesses can clearly improve. Without an onboarding solution that is swift, seamless and secure, companies will find growth more challenging and will be less able to compete with innovative rivals. There's a great stat from McKinsey on how one bank's drive to improve its customer onboarding resulted in a 25% satisfaction increase and an extra $1 billion in additional customer spend – in other words, it's absolutely worth investing in a frictionless sign-up process.

Recent research by Signicat highlights that 21% of applicants abandoned a sign-up because the process was too complicated and 38% did the same for a financial services product because they didn't have the right identity documents. So the question in those cases is how to verify customers quickly and simply. We know that bank-verified data holds the key to this problem, because it allows customers to verify their identity, autofill their details and set up direct debit payments – all in a few seconds.

.png?width=1095&height=213&name=3%20(1).png)

As a recent report by UK Finance points out, new types of fraud – such as advance fee scams – are a growing threat. But direct debit fraud is becoming the major problem for both businesses and customers. And expensive chargebacks are particularly painful for businesses trying to monitor and reduce costs. A vulnerability that onboarding processes often have is that they give scammers a chance to input stolen data – so it's really important that sign-ups can verify users are who they say they are instantly. In our recent study, only 46% of FSI leaders said they were very confident in their security posture – which suggests that there's plenty of room for improvement.

Bank-verified data gives customers and businesses alike confidence that an onboarding process can be both fast and trustworthy. Banks use rigorous, industry-leading checks – biometric security, KYC and AML, among others – to verify users. The advent of open banking means that FSI businesses can take advantage of that framework to access secure, already-checked data – which cuts out a lot of friction for customers when they apply for new products and services.

In Scandinavia, financial institutions are really advanced with digital identity solutions. Norway and Sweden use separate schemes that happen to have the same name ("BankID"); the adoption rate of BankID among Swedish adults is more than 90%. In both countries, these digital ID solutions are popular because they're easy to use and hard to hack – and they've become a part of everyday life, used for everything from simple commercial transactions to taking out a mortgage. The critical factor with bank-verified data in this case is that it gives customers a seamless experience, supported by robust security and strong compliance. So it's an extremely promising and scalable use-case.

If you have any other questions surrounding onboarding or OneID®, please get in touch with the team. You can also find out more about our research into customer onboarding for FSIs in our latest report here.

How are leading FSIs disrupting the sign-up experience?

Dive deeper into the top operational priorities and challenges of your peers and explore the future of onboarding in our new report here.

Agentic commerce is already operating inside live retail, payments, and platform environments. For Partn...

Online identity verification entered a new phase in 2025. Across adult platforms, gambling, financial se...

Last month, we joined Turnkey for an industry event to talk about a challenge many regulated platforms a...

2025 has been a year of continued growth and real-world proof for OneID®. As expectations for identity a...