New research insights: what do customers really think about online age verification?

Keeping customers - especially young people - safe is important. But so is a good customer journey. We think that when it comes to online age checks, both are possible. So, we put it to the test.

When it comes to keeping young people safe online, age verification is an absolute necessity.

But for customers who are the right age, long and confusing checkout processes can be frustrating.

For online retailers, keeping checkout processes as smooth as possible is important to keep customers happy and avoid losing revenue.

Studies show a 69.82% online cart abandonment rate with 24% of customers citing account creation as their reason for abandonment, and 18% finding the checkout process too long and complicated.

For retailers who spend time and effort creating a frictionless checkout journey, long, complicated age verification threatens revenue. Those operating on e-commerce platforms such as WooCommerce and Shopify are particularly at risk, having to use the plugins available to them to perform age verification.

With online shopping exploding in popularity, sales of age-restricted goods and services are following the same trend.

Current age check processes are flawed. Most sites use self-declaration, which is not good enough, and those who use full ID checks find their journeys long and cumbersome. The ideal AV solution needs to be:

Essentially, ideal age verification would prevent sales to minors without alienating legitimate customers.

Effective and accurate online age verification shouldn’t mean compromising on all the other important customer experience considerations your business spends so long perfecting.

Developments in digital identity tech mean that ready to use, easy to implement, and regulation compliant solutions are available. Accurate age data already exists, held by banks about their customers, meaning online banking could be utilised to verify age online.

OneID® is such a solution, as it lets customers prove their age through online banking.

We wanted to find out how online customers really feel about age verification and current methods of online age verification.

So, we conducted research that focused on three main aspects: convenience, security, and confidentiality. Here’s a look at what we found.

Current age verification methods can range from simple self-declaration methods to photo ID verifications, meaning convenience greatly varies.

We were interested to find out whether accurate and complete age checks could be achieved without ruining the customer experience.

Test participants identified convenience as important to them in online journeys like age verification, saying things such as: “Convenience, something that’s quick, something that’s not going to take 10 days just to verify my age.”

In testing, 93.75% of participants said they found OneID®, the bank supported age verification solution, very easy to use.

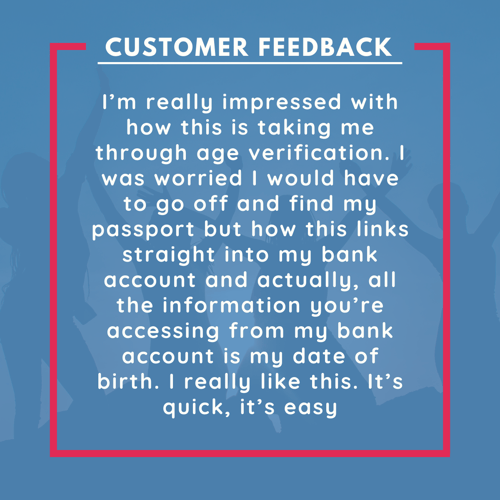

“I’m really impressed with how this is taking me through age verification. I was worried I would have to go off and find my passport but how this links straight into my bank account and actually, the only information you’re accessing from my bank account is my date of birth. I really like this. It’s quick, it’s easy.”

“That was a very, very quick process, very easy and it didn’t feel like I was giving up any of my information apart from my age which is very nice".

It is important users trust the age verification offered to them.

Our testing showed that security was even more important than convenience to users. In fact, almost 40% of people are concerned about sharing their age online for age verification according to our testing, and 68% of respondents said security was most important to them, with convenience coming in second.

Users responded positively to OneID® age verification as a more secure solution - 75% of participants still said they would feel safer sharing their date of birth online with OneID® than without it.

Users expressed feelings of trust thanks to only the necessary amount of data being collected: “I can see that there is nothing else to share except for my date of birth so absolutely, yes, I would trust that.”, and their bank being involved: “The fact that there’s facial recognition and that is linked to my Lloyds account, I couldn’t think of a more trustworthy service than my bank account... That immediately puts my mind at ease.”

44% said the security of data meant they’d use OneID® in the future, with another 44% saying the convenience would bring them back.

“It makes me feel nice and secure that it’s taking me through to my bank portal. I feel like I’m trusting it. I’m presuming my username would be up here, so I know it’s authentic.”

We also tested whether consumers really care how effective the age verification methods they use are.

Do they prefer self- declaration methods as they are faster? Or are they unhappy with the effectiveness of these? Do they find that uploading photo ID for verification takes too long, or are they indifferent?

Over 87% of respondents said they thought online age verification was very important or extremely important.

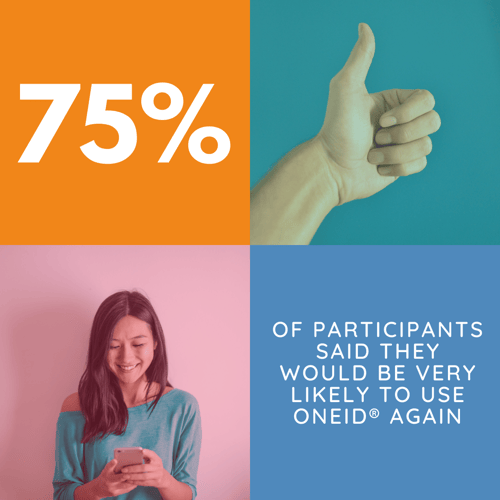

75% of participants said they would be very likely to use OneID® again and over 12% said they would be likely to use it again.

Users thought that OneID® stood apart from other methods in terms of its effectiveness in verifying age and scored the overall process 8.9/10.

“It feels a little bit superior to what other companies are doing at the moment.”

“I much prefer it to the tick box exercise which, to be honest, doesn’t fill me with any confidence at all.”

“I can see that it needs me to verify that I’m over 18 which I think is a good step because I think many kids probably get involved in gambling if they are young and their age isn’t verified so I’m happy to do this, I don’t have any concerns about verifying my age.”

According to Iain Corby, Executive Director of the Age Verification Provider’s Association (AVPA), “As we return to business as usual, we should expect to see licence officers and regulators paying significant attention to online retailers who aren’t following the rules. After an unprecedented period for everyone, things previously able to fly below the radar may not stay that way for much longer”.

Developments in digital identity mean your business can protect children and stay compliant, whilst keeping your online checkout process smooth and frictionless.

To speak to one of our experts about how your company can improve age verification grab a no-obligation chat and demo.

Agentic commerce is already operating inside live retail, payments, and platform environments. For Partn...

Online identity verification entered a new phase in 2025. Across adult platforms, gambling, financial se...

Last month, we joined Turnkey for an industry event to talk about a challenge many regulated platforms a...

2025 has been a year of continued growth and real-world proof for OneID®. As expectations for identity a...